What are prop trading challenges

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

Exclusive offer, get discount now in two steps.

Go to the website FXCI and apply our promo code «FXCI50» on the platform to save 50% and trade with $300K. Click here 👇

Introduction

Prop trading is a unique and demanding sector of the financial world. Many traders aspire to take on the challenges associated with proprietary trading firms, but the road to success is often filled with hurdles. What are prop trading challenges? This question has been asked by many prospective traders looking to enter this competitive field. In this article, we will dive into the core difficulties that traders face in prop trading, providing insights into the expectations, risks, and strategies required to overcome these challenges.

Prop trading challenges are not just about making profitable trades. They encompass everything from risk management to emotional control. Let’s break these down to understand how traders can navigate them successfully.

What are Prop Trading Challenges: Core Obstacles

1. Risk Management

A significant challenge in prop trading is the ability to manage risk effectively. Unlike retail trading, where traders risk only their own capital, prop traders must work with firm-provided capital. The challenge here lies in balancing between risk and reward.

Challenge: Managing the size of trades, ensuring no single loss wipes out profits.

Solution: Traders must follow a strict risk management strategy. This includes setting stop-loss orders, diversifying trading strategies, and limiting position sizes.

2. Emotional Control

Traders often face intense pressure, especially when their trades go wrong. Emotional decisions can lead to impulsive trading, which may result in substantial losses. The key to overcoming this challenge is maintaining discipline, even in the face of adversity.

Challenge: Emotional reactions such as fear, greed, and frustration influencing trade decisions.

Solution: Developing mental fortitude, sticking to a trading plan, and learning to accept losses as part of the process.

3. Meeting Profit Targets

Prop firms often set daily, weekly, or monthly profit targets for their traders. Failure to meet these targets can lead to termination of the trading account. This creates a high-pressure environment where consistency is key.

Challenge: Continuously meeting profit targets under pressure.

Solution: Setting realistic and achievable goals, utilizing technical and fundamental analysis to create a structured trading plan.

4. Strict Evaluation Periods

Many prop trading firms operate on an evaluation or challenge period. During this time, traders must prove their abilities by meeting certain profit or risk management criteria. This challenge can be daunting for new traders or those who are unfamiliar with the prop trading landscape.

Challenge: Proving skills during the evaluation process, which may last weeks or months.

Solution: Preparation through simulated trading, backtesting strategies, and keeping a calm mindset during evaluation periods.

Key Strategies for Overcoming Prop Trading Challenges

To succeed in prop trading, it's essential to approach challenges with a strategic mindset. Here are some strategies to help traders overcome obstacles in their journey.

Risk Mitigation

- Diversify trades: Spread the risk by diversifying trades across multiple instruments.

- Utilize stop-loss orders: Use stop-loss orders to limit potential losses on trades.

Emotional Discipline

- Practice mindfulness: Staying calm under pressure can prevent emotional decisions.

- Follow the plan: Always stick to the trading plan, regardless of the emotional state.

Achieving Consistency

- Trade regularly: Avoid large gaps in trading to maintain consistency.

- Review performance: Regularly review trading performance to make necessary adjustments.

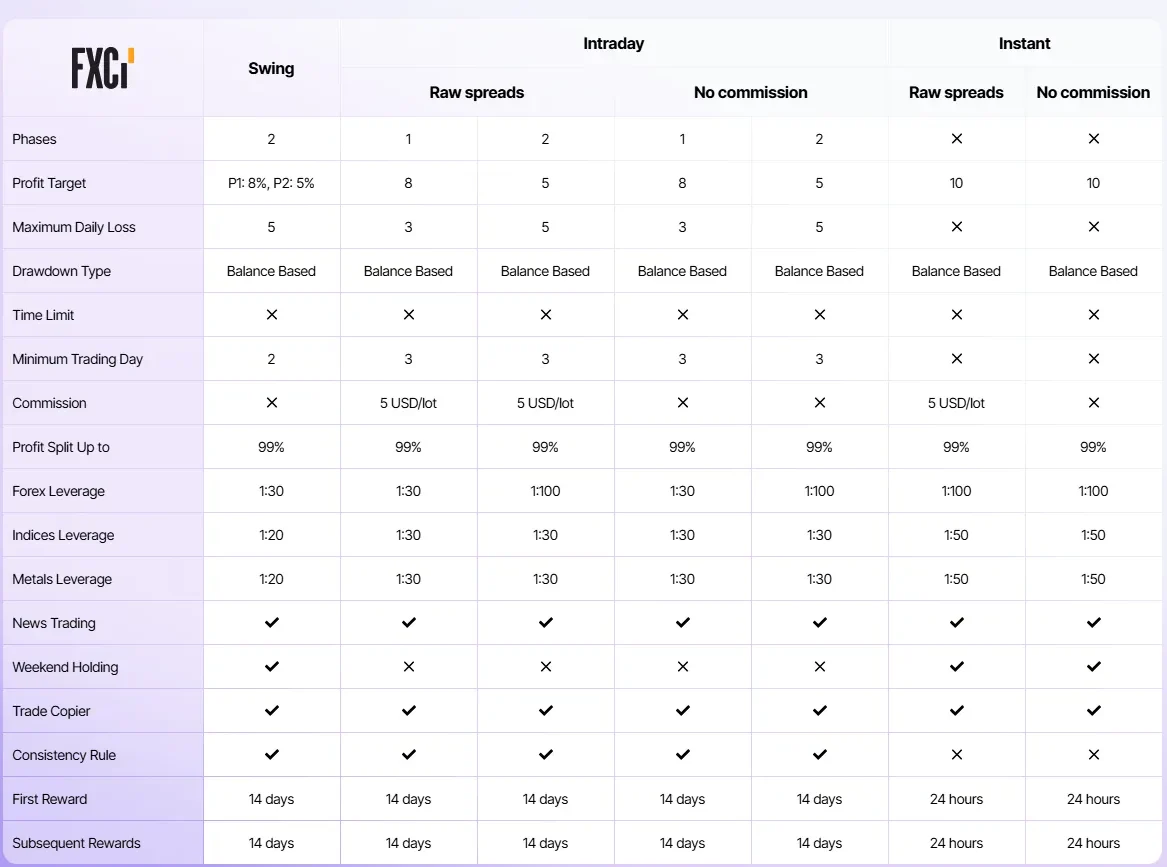

Comparison Table: Prop Trading Evaluation Criteria

| Criteria | Traditional Trading Account | Prop Trading Account |

|---|---|---|

| Capital | Trader's own | Firm's capital |

| Risk Management | Trader’s responsibility | Strict risk limits |

| Profit Targets | None | Daily/weekly/monthly |

| Evaluation Period | No evaluation | Yes, results required |

Conclusion

In summary, What are prop trading challenges? The challenges in prop trading are multifaceted, including managing risk, emotional control, meeting profit targets, and proving oneself during evaluation periods. To succeed, traders need to develop solid risk management strategies, maintain emotional discipline, and stay consistent in their performance. Preparation and a well-thought-out trading plan are vital for overcoming these challenges and thriving in the world of prop trading.

FAQ

What are the most common challenges in prop trading?

The most common challenges include risk management, emotional control, and meeting profit targets.

How do I manage risk effectively in prop trading?

Use stop-loss orders, diversify your trades, and stay within the firm’s risk limits.

What is the evaluation period in prop trading?

The evaluation period is a set timeframe during which traders must meet certain performance criteria to prove their skills.

How can I avoid emotional decisions while trading?

Develop a trading plan, stick to it, and practice mindfulness to control emotions under pressure.

What should I do if I fail the prop trading evaluation?

Analyze the mistakes, adjust your strategy, and consider reapplying after gaining more experience or improving your skills.