Strategy Psychology: How to Avoid Emotional Decisions in Prop Trading

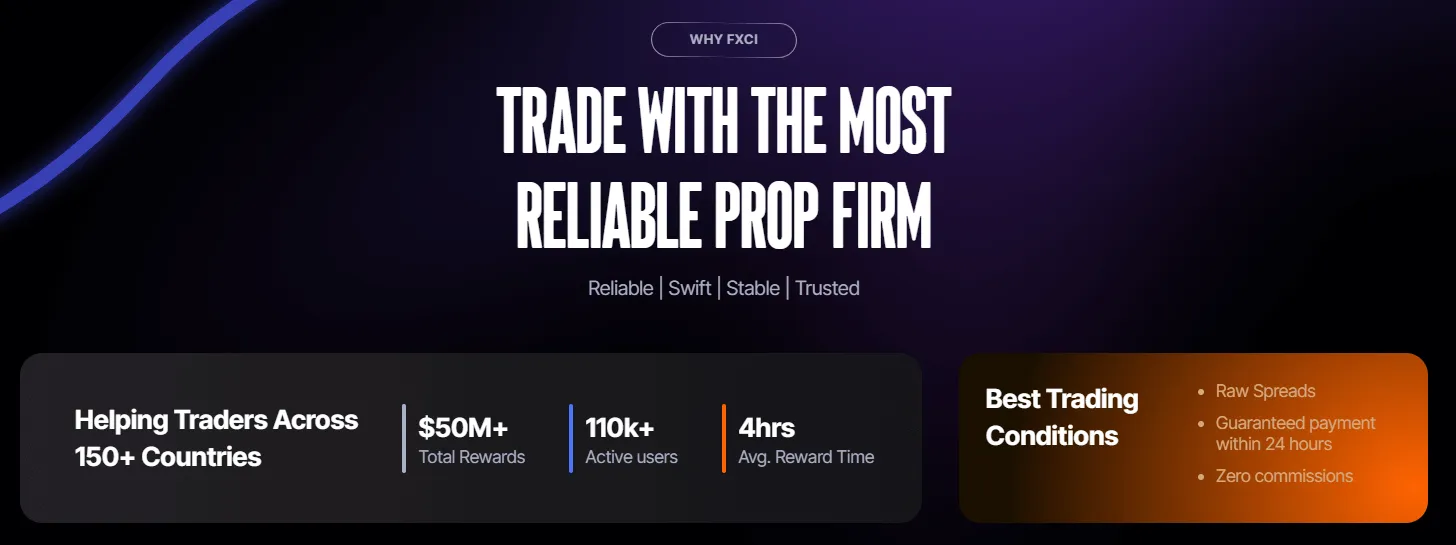

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

LAST CHANCE! Claim Your 50% Discount

Only code «FXCI50» unlocks this offer. Access $300K capital and flexible targets. Apply now👇

Introduction

In the high-pressure world of prop trading, emotions can often take over and lead to poor decision-making. The focus should always be on strategy, but emotions such as fear, greed, and impatience can cloud judgment. That’s where strategy psychology: how to avoid emotional decisions in prop trading becomes essential. Traders must learn how to manage their emotions, stick to their plans, and avoid the pitfalls that can affect their performance. In this article, we’ll dive deep into how emotional control plays a pivotal role in successful prop trading.

The Importance of Emotional Control in Prop Trading

In any trading environment, psychological factors can influence outcomes as much as market analysis. Trading psychology can impact every decision you make, from opening a position to closing one. It’s vital to understand the importance of emotional control to maintain consistency in your trading strategy. Strategy Psychology: How to Avoid Emotional Decisions in Prop Trading highlights the need for a disciplined, systematic approach.

Key Emotional Traps in Prop Trading

- Fear of Loss: This is one of the most common emotional reactions. Fear can lead to missed opportunities or the tendency to close positions too early.

- Greed: The desire for higher profits often leads traders to take excessive risks. Greed clouds judgment, pushing traders to over-leverage their positions.

- Impatience: This often results in impulsive decisions. A trader may rush into a trade or make changes to a strategy without proper analysis.

- Overconfidence: This can lead to trading beyond your means or taking on more risk than is appropriate.

Strategies for Controlling Emotions in Prop Trading

Implementing the right psychological tools can drastically improve a trader’s performance. Below are practical steps you can take to manage emotions effectively.

1. Develop a Detailed Trading Plan

A trading plan should not just include entry and exit points but also the emotional triggers that could impact decisions. Having a clear plan provides structure and helps reduce impulsive actions.

| Element | Details |

|---|---|

| Trading Goals | Set achievable targets |

| Risk Management | Define stop-loss and take-profit levels |

| Emotional Triggers | Identify stress points, e.g., fear or greed |

| Position Sizing | Limit risk per trade to a fixed percentage |

2. Practice Emotional Detachment

One of the most effective techniques is emotional detachment, where you practice not getting attached to individual trades. Losses and wins are part of the process. This mindset helps keep emotions in check.

| Aspect | Emotional Detachment | Emotional Trading |

|---|---|---|

| Decision Making | Based on strategy | Based on emotional impulses |

| Risk Tolerance | Predefined and controlled | Reactive to market movement |

| Consistency | High | Low |

3. Use of Simulation and Backtesting

Before executing strategies in real-time, simulate trades in a risk-free environment. This helps build confidence and reduces emotional stress when actual trading begins.

| Factor | Simulated Trading | Real Trading |

|---|---|---|

| Emotional Involvement | Low | High |

| Risk Management | Easier to control | Risk is real and impactful |

| Psychological Pressure | Minimal | Significant during losses |

4. Implement Regular Breaks

Taking regular breaks during trading hours prevents burnout and emotional fatigue, which can lead to poor decision-making. It also allows time for reflection and mental resets.

Conclusion

Strategy Psychology: How to Avoid Emotional Decisions in Prop Trading emphasizes the necessity of emotional control in prop trading. Traders who can keep their emotions in check are more likely to stick to their strategies, maintain discipline, and minimize errors. By developing a structured trading plan, practicing emotional detachment, using simulations, and taking regular breaks, you can enhance your decision-making process and improve your overall performance.

Trading is not just about the technicalities but also about mastering the psychological aspects. By understanding and applying the principles of strategy psychology, traders can avoid emotional pitfalls and build a sustainable, successful trading career.

FAQ

What is the role of emotions in prop trading?

Emotions such as fear, greed, and impatience can lead to poor decisions, causing losses and missed opportunities. Managing emotions is crucial to making rational trading decisions.

How can I reduce fear in trading?

Establishing a solid trading plan with predefined risk management can help reduce fear. Knowing you have a clear strategy in place can give you confidence.

What is emotional detachment in trading?

Emotional detachment means separating yourself from the outcome of a trade. This helps prevent emotional reactions to wins and losses, allowing for more rational decision-making.

Can backtesting help with emotional control?

Yes, backtesting allows you to practice strategies in a risk-free environment, which builds confidence and reduces emotional pressure when live trading.

How often should I take breaks while trading?

Taking breaks regularly throughout the trading day is important to prevent fatigue and emotional burnout, ensuring you stay focused and make better decisions.