Proprietary trading in India

Exclusive Discount Ending Soon

Your code: «FXCI50» gives 50% savings. No time limits with FXCI. Get refund after first payout. Click to join FXCI today 👇

Understanding Proprietary Trading in India

Prop trading has gained significant traction in India‘s financial landscape. This trading model allows individuals to trade using a firm’s capital, potentially earning substantial profits without risking personal funds.

Key aspects of prop trading in India include:

- Access to large trading capital up to $300.000

- Performance-based compensation

- Professional trading environment

- Advanced trading tools and platforms

- Opportunity to develop trading skills

Indian traders benefit from prop trading through:

- Reduced financial risk

- Exposure to global financial markets

- Potential for high earnings

- Access to professional-grade resources

- Networking opportunities within the trading community

Additional benefits for Indian prop traders:

- Ability to trade full-time without capital constraints

- Exposure to diverse trading strategies

- Opportunity to learn from experienced traders

- Access to prop trading algorithms and tools

- Potential for rapid career advancement in finance

The Indian Prop Trading Landscape

The Proprietary trading industry in India has evolved rapidly, offering various opportunities for local traders. Key features of the Indian prop trading market include:

- Diverse range of prop firms

- Competitive evaluation processes

- Focus on forex and commodity trading

- Growing interest from young Indian professionals

- Increasing regulatory oversight

Challenges faced by Indian prop traders:

- Limited awareness of prop trading concepts

- Currency fluctuations affecting profit calculations

- Internet connectivity issues

- Need for specialized education and training

- Competition from international prop trading firms

Recent developments in the Indian prop trading scene:

- Emergence of local prop trading educational institutions

- Increased collaboration between prop firms and universities

- Growing number of Indian traders succeeding internationally

- Introduction of cryptocurrency trading in some prop firms

- Rising interest in algorithmic and high-frequency trading

FXCI Proprietary Trading Offering in India

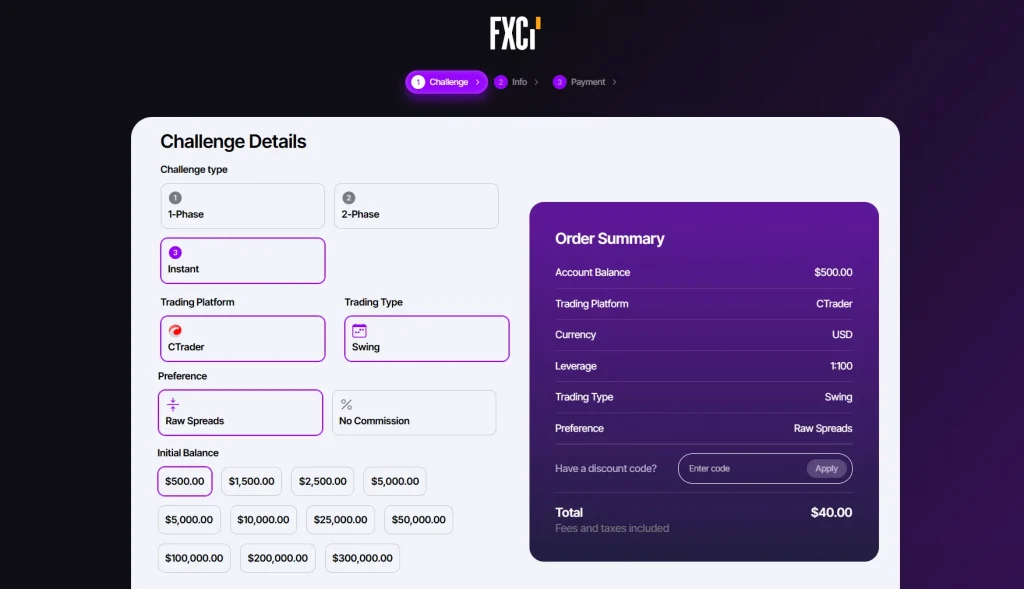

At FXCI, we provide a comprehensive prop trading program tailored for Indian traders. Our offering includes:

- Account sizes ranging from $500 to $300,000

- Two-phase evaluation process

- Profit split up to 99% for successful traders

- Access to YFT and cTrader platforms

- Wide range of tradable instruments

| Challenge Type | Phases | Minimum Trading Days | Profit Target | Maximum Drawdown | Maximum Daily Loss | Account Sizes Available (USD) | Refundable Fee (USD) |

| Boosted | 1 | 3 | 10% | 5% | 3% | $5,000 – $200,000 | $59 – $959 |

| Unlimited | 2 | 0 | Phase 1: 8%, Phase 2: 5% | 10% | 5% | $5,000 – $200,000 | $49 – $949 (Free for some) |

| Swing | 1 | P1: 8%, P2: 5% | P1: 8%, P2: 5% | 10% | 5% | $5,000 – $200,000 | $69 – $1097 |

| Intraday | 1 or 2 | 3 | P1: 8%, P2: 5% or 10% in 1 Phase Type | 5%-10% | 3%-5% | $5,000 – $200,000 | $49 – $959 |

| Instant | 1 | – | – | 10% | – | $500 – $300,000 | $40 – $15.000 |

FXCI's Unique Advantages for Indian Prop Traders

FXCI stands out in the Indian prop trading market due to:

- Flexible trading conditions

- No time limits on evaluation phases

- Support for various trading strategies, including EAs

- Comprehensive educational resources

- Active community support via Discord

- Regular payouts twice a week

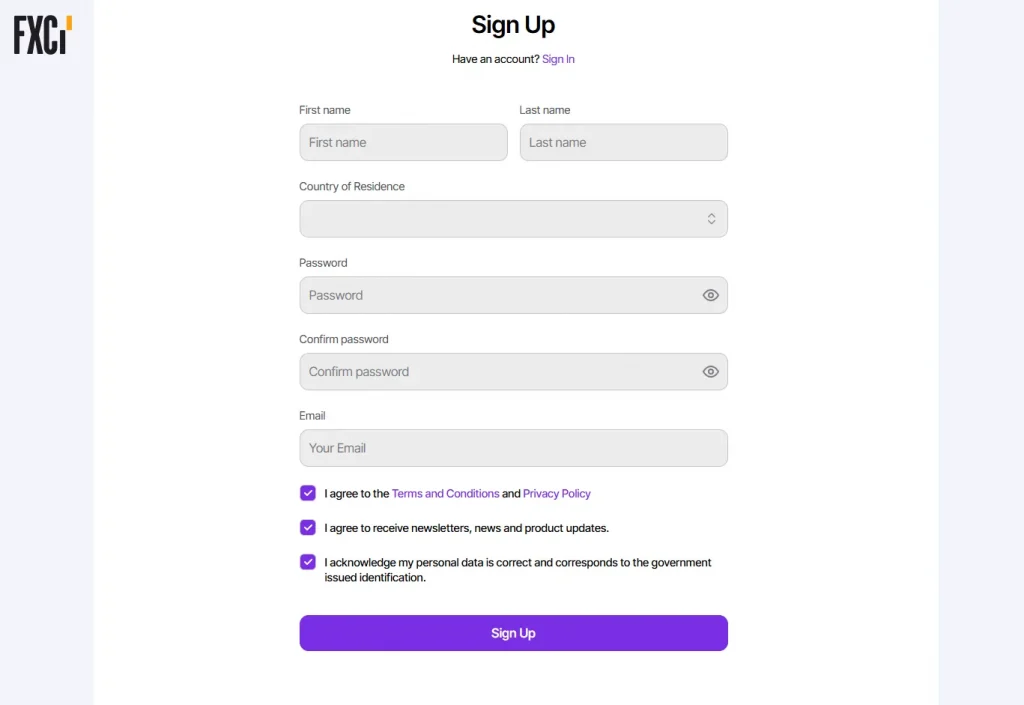

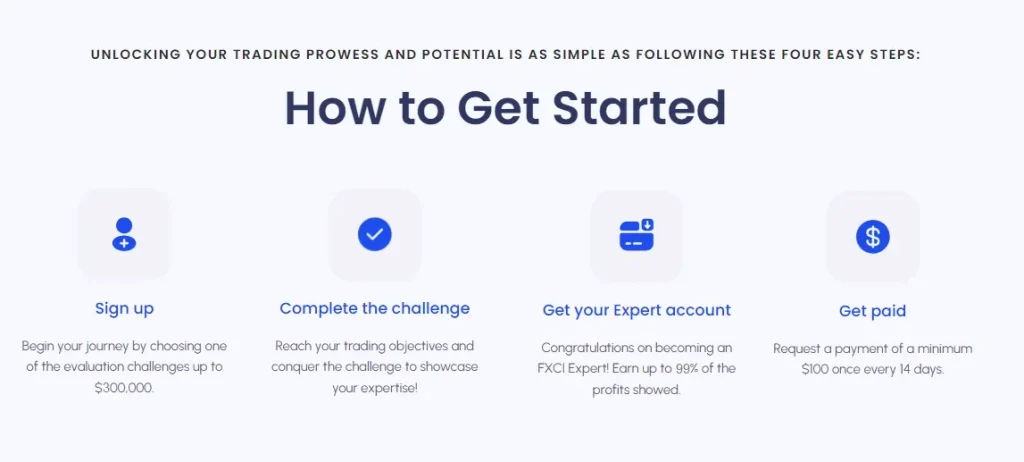

Getting Started with FXCI Prop Trading in India

To begin your prop trading journey with FXCI:

- Visit FXCI website and choose your account size

- Complete the registration process

- Fund your account using available payment methods

- Start the Phase 1 evaluation

- Upon successful completion, proceed to Phase 2

- Pass Phase 2 to receive your funded account

Our support team is available to assist you throughout the process.

Risk Management in Prop Trading

Effective risk management is crucial for success in prop trading. FXCI emphasizes the following risk management principles:

- Adherence to maximum daily loss limits

- Monitoring of overall account drawdown

- Proper position sizing

- Use of stop-loss orders

- Diversification across multiple instruments

- Regular performance analysis and adjustment

Education and Support for Indian Prop Traders

FXCI provides extensive educational resources and support:

- Video tutorials on trading strategies

- Blog with industry experts

- Daily market analysis

- Regular performance feedback

- Customer support

FAQ

FXCI’s prop trading program allows Indian traders to access large trading capital without personal risk. We provide the funds, technology, and support, while traders focus on developing their skills and generating profits.

Successful traders have the opportunity to scale their accounts, increasing the capital they manage and potentially their profit share. We offer a scaling plan that can increase your account size by 10% every two months of profitable trading.

While trading experience can be beneficial, it is not mandatory. Our evaluation process is designed to identify skilled traders, regardless of their background. We provide educational resources to help traders at all levels improve their skills.