Prop trading secrets: how successful traders are living off the markets

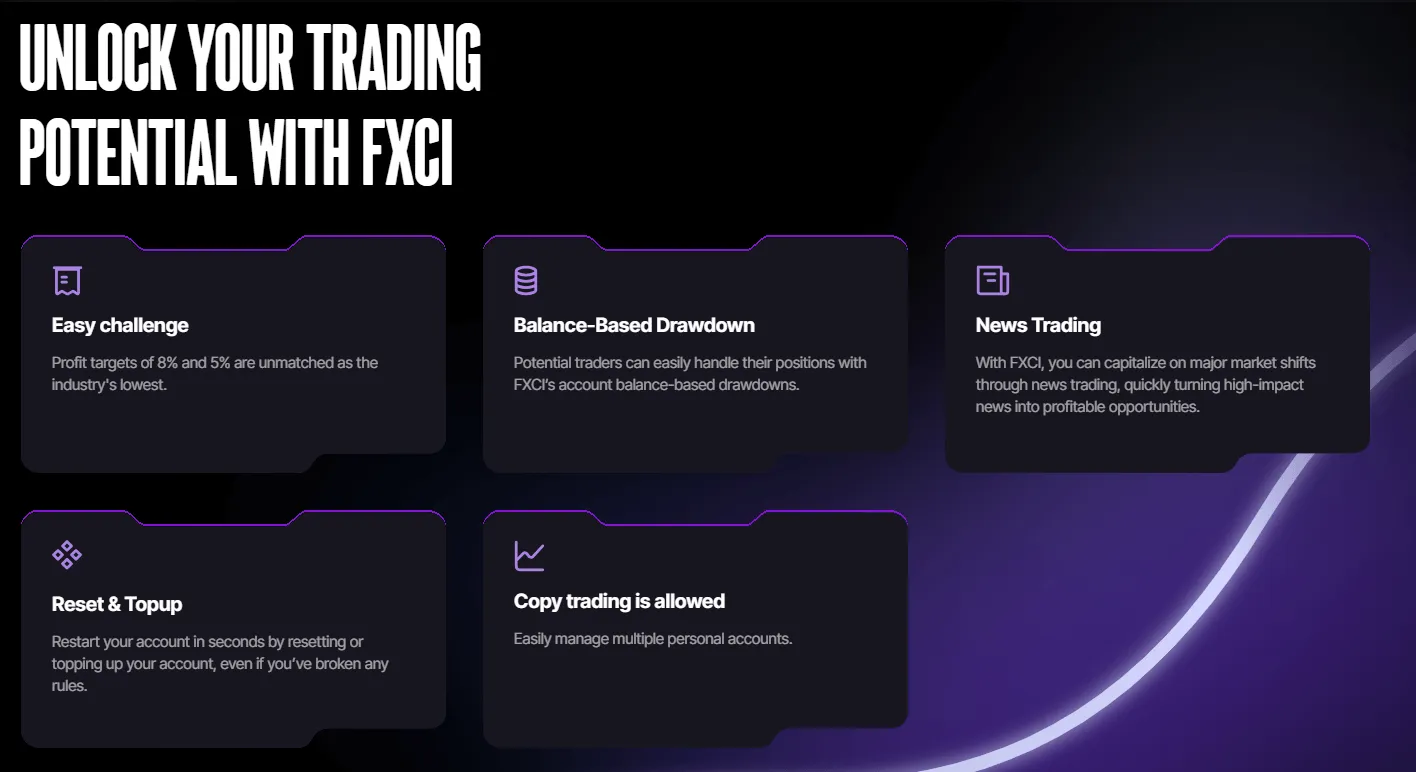

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

Start your prop trading journey with FXCI at a discounted rate! Apply promo code «FXCI50» to get 50% off your challenge fees and trade with the lowest targets.

Introduction

Prop trading is not just about chance or sheer luck; it’s about developing the right strategies and maintaining disciplined practices to succeed consistently. Prop trading secrets: how successful traders are living off the markets is a topic that covers everything from risk management to leveraging market data for trading strategies. In this article, we’ll break down how professional traders make a living from the markets and what you can learn from them.

Prop trading allows traders to access firm capital, meaning they can focus on trading without the financial pressure that often comes with using personal funds. The profits are shared, but with proper strategies, traders can earn substantial returns. Let's dive into Prop trading secrets: how successful traders are living off the markets.

The Core of Prop Trading: Understanding the Foundation

Prop trading differs significantly from retail trading. Instead of risking their own money, traders use capital provided by prop firms. The trading strategies they employ must be finely tuned, and they must be able to adapt quickly to market changes.

Here are the key factors that define the success of prop traders:

- Capital Access: Prop traders trade with firm-provided funds, giving them a much larger trading capacity than most retail traders.

- Risk Management: Effective risk management strategies are crucial for minimizing losses and maximizing profits.

- Profit Sharing: Traders typically share a portion of their profits with the firm. However, the more successful they are, the higher their profit percentage.

- Leverage: Traders often use leverage to increase their buying power, allowing them to trade larger positions with smaller capital.

Key Strategies for Successful Prop Traders

Successful prop traders rely on strategies that consistently yield profits while managing risk effectively. Here are some common strategies used in the industry:

- Scalping: Scalpers make numerous small trades throughout the day, capitalizing on minor price movements. This strategy works well for those who can stay focused for long periods of time and are good at managing risk.

- Trend Following: Trend following strategies aim to profit from market momentum. Traders identify a market trend and stay in the position as long as the trend persists.

- Mean Reversion: This strategy assumes that prices will revert to a mean value over time. Traders buy when the price dips below the average and sell when it goes above it.

- News Trading: Successful traders often capitalize on market volatility caused by news events. By anticipating the market's reaction to news, they can make quick and profitable trades.

- Algorithmic Trading: Many prop traders use automated strategies to execute trades faster and more efficiently. Algorithms can process vast amounts of market data and identify trends that human traders might miss.

Tools That Help Prop Traders Succeed

Prop traders have access to some of the best trading tools, which provide them with an edge over retail traders. These tools help them make informed decisions quickly and manage their trades effectively.

| Tool | Description |

|---|---|

| Trading Platforms | Advanced platforms with features like real-time data and multiple charting tools. |

| Market Analysis Software | Software that provides insights and predictions based on historical data. |

| Automated Trading Systems | Pre-programmed strategies that execute trades without human intervention. |

| Risk Management Tools | Tools that help traders calculate position sizes and manage risk effectively. |

These tools enable prop traders to maintain an edge in the highly competitive trading world.

Building a Trading Strategy for Long-Term Success

To live off the markets as a prop trader, success doesn't come overnight. Traders need to continually refine their strategies and adapt to changing market conditions. Here are some practical tips for building a strategy:

- Backtesting: Test strategies on historical data to understand their potential effectiveness in various market conditions.

- Continuous Learning: The market is constantly evolving, so continuous learning and adaptation are necessary.

- Discipline: Stick to your strategy and avoid emotional trading decisions.

- Diversification: Trade multiple instruments to reduce risk. Spreading trades across assets can help weather market volatility.

| Strategy | Win Rate | Average Return per Trade | Risk/Reward Ratio |

|---|---|---|---|

| Scalping | 65% | 0.5% | 1:1 |

| Trend Following | 70% | 1.5% | 1:2 |

| Mean Reversion | 60% | 1% | 1:3 |

Risk Management: The Key to Staying Profitable

Risk management is crucial for long-term success. Without it, even the best traders can face ruin. Here’s how top prop traders manage risk:

- Stop Loss Orders: Set stop loss levels to minimize potential losses on trades.

- Position Sizing: Always trade with an appropriate position size based on the risk level.

- Diversification: Spread risk by diversifying across different asset classes or trading strategies.

- Risk-to-Reward Ratio: Maintain a favorable risk-to-reward ratio for every trade. Ideally, aim for a 1:2 or 1:3 ratio to ensure that profits outpace losses.

Conclusion

In conclusion, the world of prop trading is complex and challenging, but for those who understand the core strategies, risk management principles, and tools at their disposal, it offers significant opportunities. The secrets of successful traders are rooted in disciplined strategies, continuous learning, and effective risk management.

If you aim to follow in the footsteps of these traders, developing a structured approach, learning from past mistakes, and continuously adapting to the market are your best tools. Remember, Prop trading secrets: how successful traders are living off the markets is a combination of smart strategy, proper execution, and emotional control.

FAQ

What is the best strategy for prop trading?

The best strategy depends on individual preferences and market conditions, but trend following and scalping are commonly used.

How do prop firms evaluate traders?

Prop firms typically evaluate traders based on their ability to generate consistent profits while managing risk effectively.

Can I start prop trading with little experience?

While experience helps, many firms offer training and testing to help new traders develop their skills.

What is the typical profit split for prop traders?

Profit splits vary, but traders can typically keep 70% to 85% of their profits, depending on the firm.

How much capital do I need to start prop trading?

The amount of capital required can vary, but many prop firms allow traders to begin with as little as $500, while they provide additional leverage.