How to start crypto prop trading

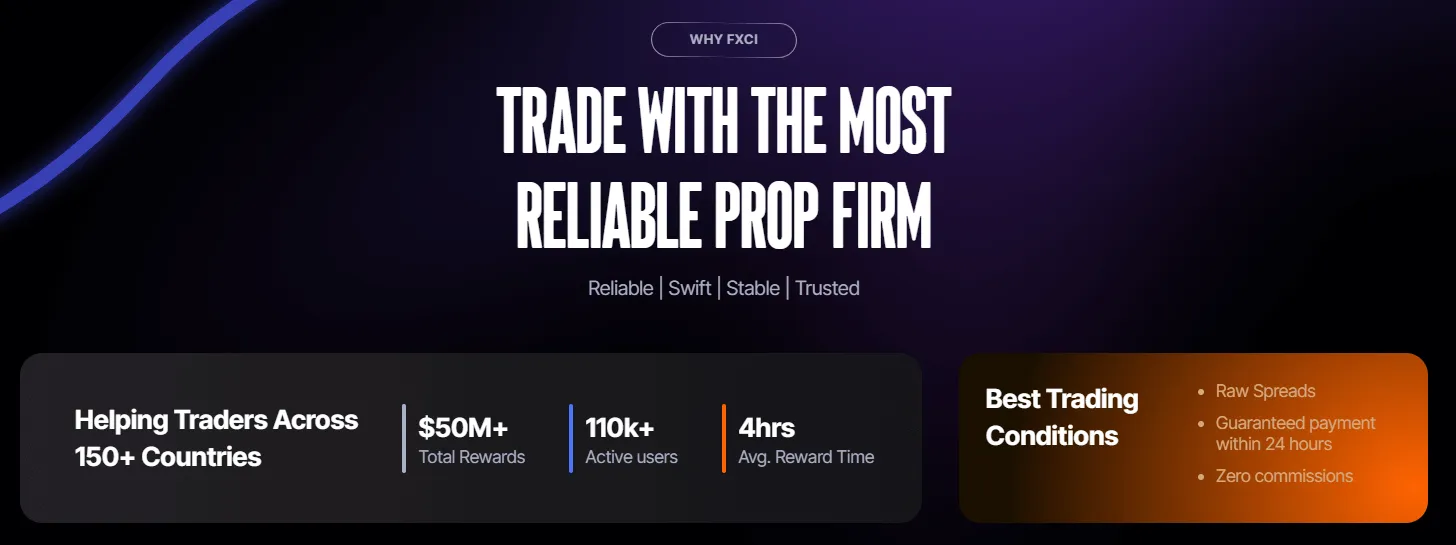

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

LAST CHANCE! Claim Your 50% Discount

Only code «FXCI50» unlocks this offer. Access $300K capital and flexible targets. Apply now👇

Introduction

The world of prop trading, particularly in the cryptocurrency market, is growing rapidly. If you are considering diving into the crypto space as a prop trader, understanding how to start crypto prop trading is crucial. The process involves both opportunity and challenge, with potential for profit, but also risks that need careful management. This article will explore what crypto prop trading is, how to get started, and essential strategies to keep in mind. By the end, you'll have a clear understanding of the steps required to enter the crypto prop trading world.

What is Crypto Prop Trading?

Crypto prop trading allows individuals to trade cryptocurrency using the capital of a firm. Instead of investing personal funds, traders trade with the firm's money and keep a portion of the profits. This model benefits traders by providing them with resources they might not otherwise have, while firms benefit from talented traders without taking on the risk of investment capital. To get started, it's important to understand the fundamentals of crypto trading, risk management, and the specifics of prop firms.

Steps on How to Start Crypto Prop Trading

1. Understanding the Basics of Cryptocurrency

Before diving into prop trading, it's essential to have a solid understanding of cryptocurrency markets. Cryptocurrencies are highly volatile, and understanding the assets you’ll trade is key to making informed decisions.

Key Points:

- Learn the difference between major cryptocurrencies like Bitcoin, Ethereum, and altcoins.

- Study market patterns and trading behavior.

- Stay informed about market trends, regulations, and news that affect prices.

2. Choosing a Prop Trading Firm

The next step in learning is selecting the right prop trading firm. These firms offer various structures and conditions, including profit splits, fees, and risk management rules.

Factors to Consider:

- Profit share percentage (often ranging from 70% to 90%).

- Fees associated with challenges or platforms.

- Support and educational resources offered.

| Prop Firm Feature | Firm 1 | Firm 2 | Firm 3 |

|---|---|---|---|

| Profit Split | 80% | 85% | 90% |

| Monthly Fees | $50 | $75 | $100 |

| Platform Support | High | Medium | High |

| Educational Content | Yes | No | Yes |

3. Complete the Evaluation Process

Most prop trading firms require traders to pass an evaluation process, which typically involves trading a demo account to demonstrate your skills before you are given live capital. This process varies across firms but is a common part.

Steps:

- Understand the evaluation rules (e.g., maximum drawdown limits, profit targets).

- Pass the demo trading challenge.

- Start trading with live capital after meeting requirements.

4. Develop a Trading Strategy

A well-developed trading strategy is crucial to successful crypto prop trading. It's essential to choose a trading style (scalping, day trading, swing trading, etc.) that fits your personality and risk tolerance.

Popular Trading Strategies:

- Scalping: A short-term strategy focused on small, frequent profits.

- Trend Following: Aiming to profit from sustained market trends.

- Range Trading: Trading within a defined price range.

| Strategy | Risk | Profit Potential | Best For |

|---|---|---|---|

| Scalping | High | Low | Active traders |

| Trend Following | Medium | High | Long-term traders |

| Range Trading | Low | Medium | Traders in stable markets |

5. Risk Management

Risk management is one of the most important aspects of successful crypto prop trading. Even the most skilled traders can experience losses, and managing those losses is key to long-term profitability.

Effective Risk Management:

- Use stop-loss orders to limit potential losses.

- Set a maximum loss percentage per trade (e.g., 1-2% of your capital).

- Diversify your trades to reduce exposure.

Tips for Success in Crypto Prop Trading

1. Stay Educated

Crypto markets are constantly evolving, and successful traders stay informed. Regularly read market analyses, attend webinars, and consider furthering your education on advanced trading concepts and strategies.

2. Master Technical Analysis

In crypto prop trading, understanding charts, indicators, and patterns is crucial. Familiarize yourself with technical analysis tools like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

3. Control Emotions

One of the most significant challenges in trading is controlling emotions. Fear and greed can lead to poor decision-making. Developing emotional discipline is crucial in how to be successful in the long term.

Conclusion

In conclusion, how to start crypto prop trading involves several critical steps: understanding the market, choosing the right firm, passing the evaluation, developing a trading strategy, and implementing sound risk management practices. By approaching these steps systematically and staying disciplined, traders can successfully navigate the crypto prop trading space. Whether you're just starting or looking to refine your approach, the potential rewards in this dynamic market are significant. Just remember, it requires hard work, education, and emotional control to succeed.

FAQ

What is the best way to start crypto prop trading?

Start by understanding cryptocurrency markets, selecting a reputable prop firm, and passing their evaluation process. Educate yourself continuously and develop a solid risk management strategy.

How much capital do I need to start crypto prop trading?

The amount varies by firm, but most firms offer the opportunity to trade with their capital after passing an evaluation. Initial fees for evaluations can range from $50 to $100.

How do I choose the best prop firm for crypto trading?

Look for a firm with favorable profit splits, a clear evaluation process, and solid support. Consider the resources they provide, like training materials, and compare fees.

What trading strategies should I use in crypto prop trading?

Popular strategies include scalping, trend following, and range trading. Choose a strategy that aligns with your trading style and risk tolerance.

Is it possible to make a living from crypto prop trading?

Yes, but it requires skill, discipline, and a good strategy. Consistent profits are achievable with the right approach to risk management and strategy development.