How to Pass a Prop Firm Challenge in India

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

EXCLUSIVE!

We offer you a promo code to start your journey in prop trading profitably. Apply «FXCI50» on the FXCI website to get a discount on challenges and earn up to 99% profit trading.

Introduction: Understanding the Prop Firm Challenge

For aspiring traders, how to pass a prop firm challenge is an important question. A prop firm challenge is the first step toward gaining access to a firm’s trading capital, which can provide a significant opportunity to trade and earn profits without using personal funds. However, passing the challenge is not easy. It requires skill, discipline, and a strategic approach.

In India, where prop trading is gaining popularity, more traders are looking to take advantage of these opportunities. If you’re considering taking on a prop firm challenge, understanding the process and the steps involved is essential to increase your chances of success. This article will guide you through the key strategies and tips on how to pass a prop firm challenge.

Key Steps for Passing a Prop Firm Challenge

1. Understand the Rules and Requirements

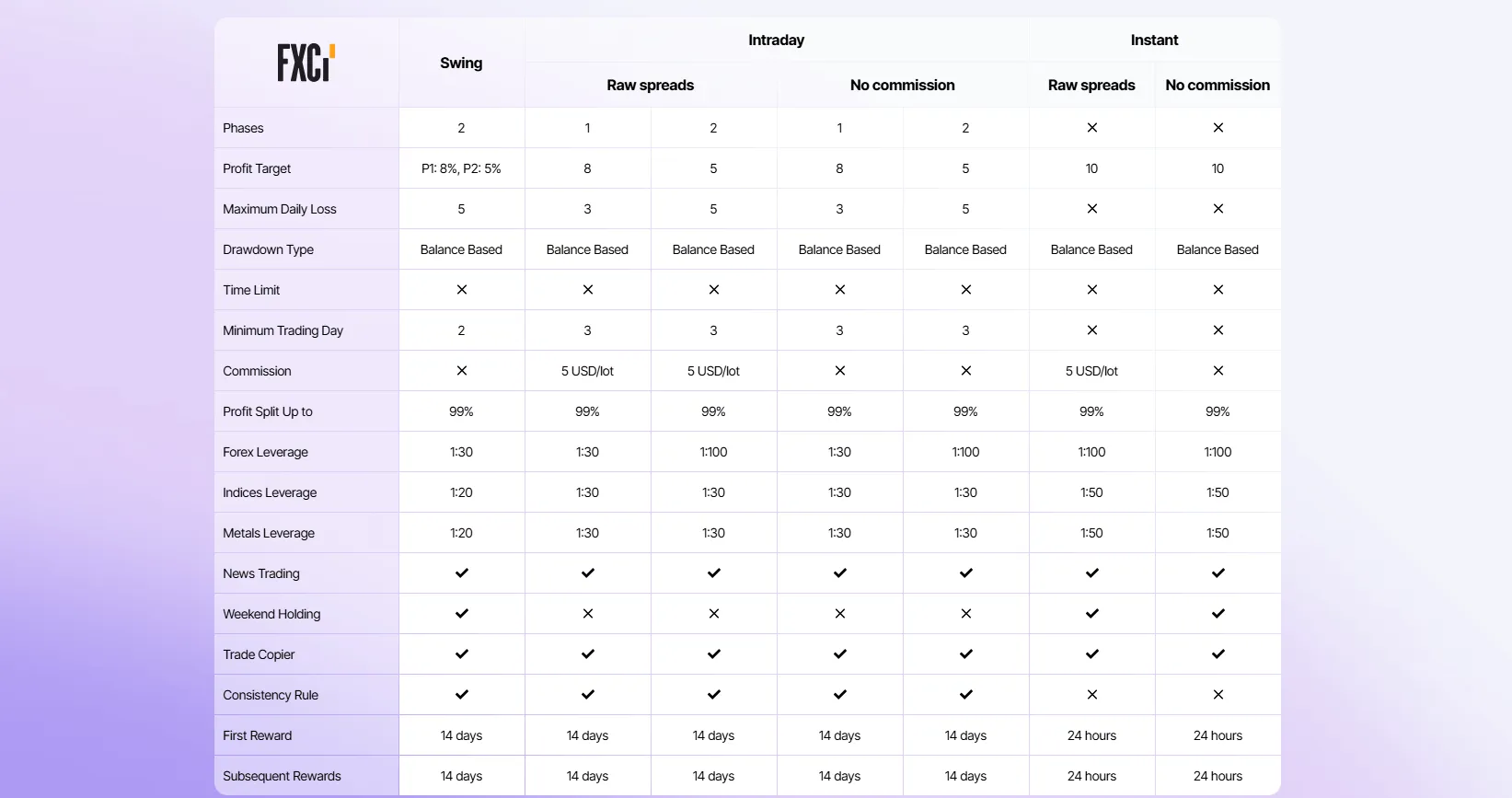

The first step in how to pass a prop firm challenge is to fully understand the rules set by the firm. Each prop firm has its own set of requirements, and knowing them will help you plan your approach effectively. Some of the key aspects to focus on include:

- Profit Targets: Every prop firm challenge comes with a specific profit target. Understanding how much profit you need to generate within a set time frame is crucial.

- Risk Limits: Prop firms often have strict risk limits, such as maximum daily losses or drawdowns. Knowing these limits and staying within them is essential.

- Trading Strategy: Firms may have guidelines on the types of strategies that are allowed or preferred. Ensure that your strategy aligns with the firm's expectations.

2. Develop a Solid Trading Plan

To successfully pass a prop firm challenge, it’s essential to have a well-defined trading plan. Your plan should be based on sound strategies that focus on consistency and risk management. Here are some elements to include in your trading plan:

- Risk Management: Determine how much of your capital you will risk per trade. It’s recommended to risk only 1% to 2% of your account per trade to minimize the chances of hitting the firm’s loss limits.

- Profit Targets: Set realistic daily or weekly profit targets to stay on track. Don’t aim for massive profits in a short period, as this can lead to unnecessary risk.

- Trading Times: Define the hours during which you will trade. Avoid trading during highly volatile times unless it aligns with your strategy.

3. Focus on Consistency, Not Big Wins

Many traders try to achieve large profits quickly during a prop firm challenge, but this can lead to mistakes and emotional trading. Instead, focus on consistent, small profits that add up over time. Most prop firms value consistency over big wins, so aim to stay within your risk parameters while achieving steady returns.

4. Track Your Progress and Adjust

During the challenge, track your trading performance regularly. Monitoring your progress will help you identify areas where you may be taking too much risk or not achieving your profit targets. Adjust your strategy accordingly and stick to your plan.

5. Stay Calm and Manage Your Emotions

One of the most important aspects of how to pass a prop firm challenge is emotional control. Don’t let fear or greed drive your trading decisions. If you experience a loss, don’t chase it by taking on higher-risk trades. Similarly, don’t overtrade after a big win. Stay disciplined, follow your strategy, and keep your emotions in check.

| Factor | Description | Why It's Important |

|---|---|---|

| Profit Targets | The required profit percentage within a set time. | Helps you measure success and keep track of progress. |

| Risk Limits | The maximum loss or drawdown allowed. | Prevents excessive risk and protects the firm's capital. |

| Consistency | Steady, consistent profits over a period of time. | Firms prefer steady performance over high-risk wins. |

| Risk Management | Controlling the amount you risk per trade. | Keeps your losses manageable and helps avoid hitting limits. |

| Emotional Control | Managing emotions during losses or wins. | Essential for making rational decisions under pressure. |

Tips to Maximize Your Chances of Success in the Prop Firm Challenge

1. Start Small

Many prop firms offer challenges with different levels of difficulty. If you're new to prop trading, start with a smaller account or a less difficult challenge to build your skills and gain experience.

2. Use Proper Leverage

Leverage can amplify profits, but it also increases risks. Use leverage cautiously during the challenge. Excessive leverage can quickly lead to significant losses, which may result in failure to pass the challenge.

3. Stick to Your Strategy

Don’t change your trading strategy just because the challenge is tough. Stick to what works for you and adjust only when necessary. If your strategy is sound, don’t deviate from it, even if you face temporary setbacks.

4. Don’t Overtrade

It can be tempting to trade more frequently to meet profit targets, but overtrading often leads to mistakes. Focus on quality trades rather than quantity. This will help you manage risk and increase the likelihood of passing the challenge.

5. Avoid Emotional Trading

Fear and greed are two emotions that can significantly impact your trading. Stick to your plan and avoid making impulsive decisions when faced with market volatility. Emotional trading often leads to poor decisions and failure to meet the challenge requirements.

Conclusion: Succeeding in a Prop Firm Challenge

Passing a prop firm challenge requires discipline, a solid strategy, and effective risk management. By focusing on consistency, managing your emotions, and sticking to a plan, you can significantly increase your chances of success. While prop firm challenges may seem daunting, they offer a great opportunity for traders who are disciplined and ready to trade with larger capital.

By understanding the challenge requirements, developing a trading plan, and maintaining a calm mindset, you’ll be well-prepared to meet the challenge and gain access to capital for trading. Keep working on your strategy, stay focused, and take it one trade at a time.

FAQ: Common Questions About How to Pass a Prop Firm Challenge

What is a prop firm challenge?

A prop firm challenge is an evaluation process where traders must meet specific profit targets and risk management criteria set by the firm to gain access to trading capital.

How long does a prop firm challenge take?

The duration of a prop firm challenge varies, but it typically ranges from a few weeks to a couple of months, depending on the firm’s rules.

Can I fail the prop firm challenge?

Yes, you can fail the challenge if you exceed the drawdown limit or fail to meet the profit targets within the given timeframe.

How much capital do I get after passing the challenge?

The amount of capital provided after passing the challenge varies between firms, but it can range from $10,000 to several hundred thousand dollars, depending on your performance.

Can I use leverage in the prop firm challenge?

Yes, most prop firms offer leverage, but they also impose strict limits to manage risk. It’s important to use leverage cautiously to avoid large losses.