How to Combine Different Strategies for Successful Prop Trading

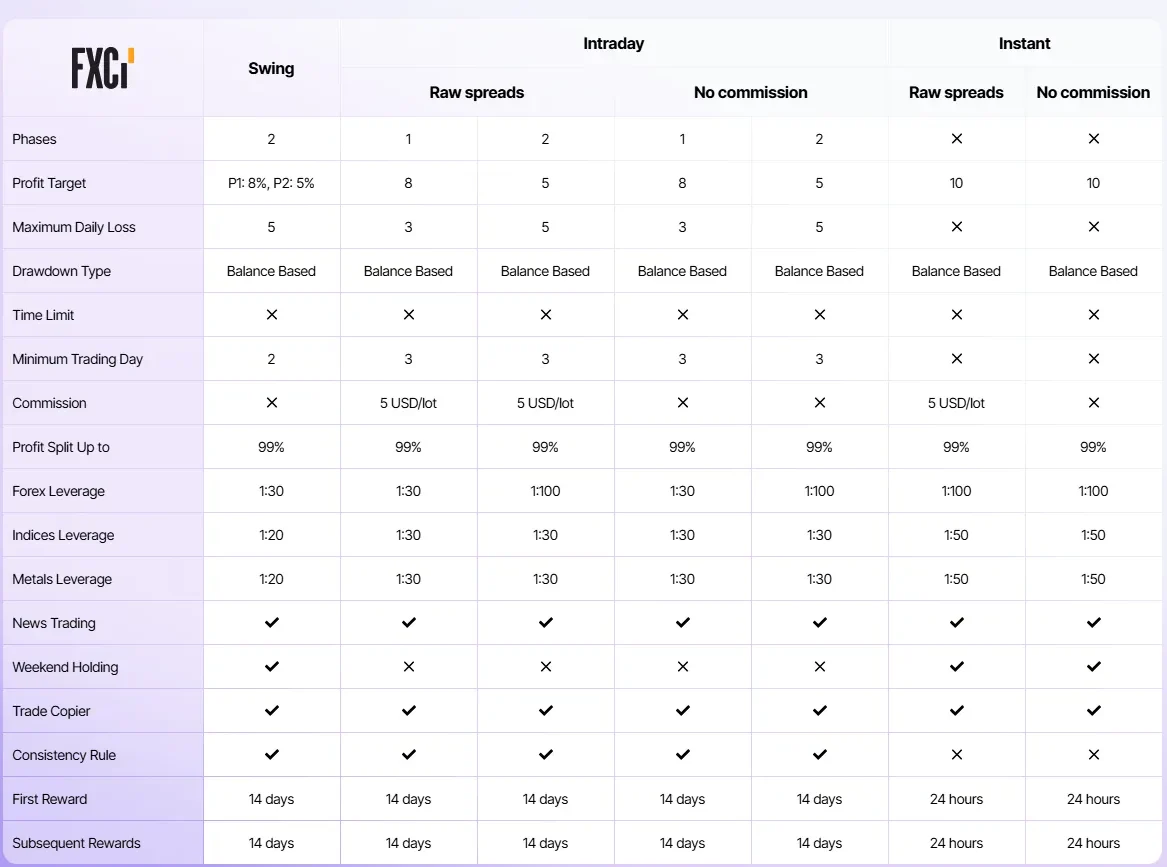

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

Exclusive Discount Ending Soon

Your code: «FXCI50» gives 50% savings. No time limits with FXCI. Get refund after first payout. Click to join FXCI today 👇

Introduction

In prop trading, combining different strategies can be a powerful approach to maximize profits and reduce risks. How to Combine Different Strategies for Successful Prop Trading is a key question for traders looking to optimize their performance. This article will explore how using a mix of strategies can work together to create a balanced, effective trading plan. By integrating different styles and techniques, traders can better adapt to varying market conditions and achieve consistent results.

We’ll look at practical examples of how these strategies can be combined, focusing on using platforms like FXCI, where traders can access firm-provided capital and trade with greater flexibility. Additionally, testing and analyzing trading strategies for prop firms is essential to assess their effectiveness and identify the best approaches.

How to Choose Strategies for Prop Trading

When deciding which strategies to combine, it’s essential to understand the market environment and your personal trading preferences. Here are a few points to consider:

- Risk tolerance: Some strategies may involve higher risks, while others are more conservative. By combining these, you can balance your overall exposure.

- Market conditions: Certain strategies work better in specific market conditions. Combining approaches like trend-following and range-trading can help you stay profitable in both volatile and stable markets.

- Time commitment: Some strategies require more time and analysis, while others are more automated. Mixing short-term and long-term strategies can help you manage your time effectively while maintaining a steady income.

Types of Strategies to Combine

Trend-Following Strategy

This strategy works by identifying and following the prevailing market trend. It can be very profitable in strong market movements but requires patience and the ability to stay in a trade as long as the trend continues.

Mean Reversion Strategy

This approach bets on price returning to its average. It’s useful in markets that oscillate between support and resistance levels, providing a good counterpoint to trend-following methods.

Scalping

Scalping involves making quick, small trades to profit from minor price fluctuations. This works well for day traders and can be combined with longer-term strategies for a diversified approach.

Swing Trading

Swing trading targets price swings in the market, often holding positions for a few days or weeks. This can be combined with trend-following strategies to identify key entry points.

Practical Example of Combining Strategies on FXCI

Let’s break down an example where a trader combines trend-following with mean reversion on the FXCI platform:

Trend-Following Setup:

- The trader identifies a strong upward trend in a currency pair using moving averages (50-day and 200-day MA crossovers).

- They open a position when the price breaks above a key resistance level, with a take-profit set based on recent highs.

Mean Reversion Setup:

- The trader uses Bollinger Bands to identify an overbought market condition.

- When the price touches the upper band and starts to turn, they take a short position, expecting the price to revert to the mean.

By combining these two strategies, the trader can capture gains during the trend while also taking advantage of potential pullbacks or price corrections. Additionally, Testing and Analyzing Trading Strategies for Prop Firms will help ensure that this combination is effective in achieving the desired results.

How to Optimize the Combined Strategies for Maximum Effectiveness

Combining strategies isn’t just about choosing two or more approaches at random. It requires optimizing them for the best results. Here’s how you can fine-tune the combinations:

Diversification of Timeframes: Use shorter timeframes for quick trades (scalping) and longer timeframes for more stable trends (swing trading). This way, you can ensure a balanced risk-to-reward ratio while adapting to market movements.

Position Sizing: By adjusting your position sizes based on the risk of each strategy, you can ensure that you’re not overexposed in any one trade. For example, using a smaller size on high-risk strategies like mean reversion and a larger size on trend-following trades can create a balanced approach.

Utilizing Tools on FXCI: The FXCI platform offers advanced tools for tracking trades and managing risk. Use features like real-time analytics, stop-loss, and take-profit orders to fine-tune your strategy execution.

| Strategy | Risk Level | Best Market Conditions | Time Horizon |

|---|---|---|---|

| Trend-Following | Medium | Strong trending markets | Medium to Long Term |

| Mean Reversion | Low | Range-bound markets | Short to Medium Term |

| Scalping | High | Volatile markets | Short Term |

| Swing Trading | Medium | Price swing conditions | Medium Term |

| Strategy | Expected Outcome | Recommended Risk Management |

|---|---|---|

| Trend-Following | High profit in trending conditions | Use trailing stops and risk-reward ratio of 1:3 |

| Mean Reversion | Quick profits in range-bound markets | Use tight stop-loss and risk-reward ratio of 1:2 |

| Scalping | Small, frequent gains | Limit exposure to one asset and use quick stop-loss |

| Swing Trading | Steady profits in volatile conditions | Hold trades for a few days, use stop-loss |

Conclusion

How to Combine Different Strategies for Successful Prop Trading is not just about using two or more strategies, but about optimizing them for a balanced and effective approach. By understanding each strategy’s strengths and weaknesses, traders can leverage them to their advantage. Whether you’re using trend-following combined with mean reversion or adding scalping and swing trading to your toolkit, it’s crucial to find the right mix for your trading style and risk tolerance.

Moreover, Testing and Analyzing Trading Strategies for Prop Firms will play a critical role in helping you fine-tune your strategy combinations and measure their effectiveness. The key takeaway is that combining strategies allows you to be adaptable, manage risks better, and potentially improve overall profitability. By practicing and refining your approach on platforms like FXCI, you can increase your chances of long-term success in prop trading.

FAQ

What are the best strategies for prop trading?

The best strategies vary depending on your risk tolerance and market conditions. Commonly used strategies include trend-following, mean reversion, and swing trading.

How can I combine strategies effectively?

Combine strategies by diversifying your timeframes, adjusting your position sizes, and using risk management tools to balance risk and reward.

Can I use multiple strategies on FXCI?

Yes, FXCI offers a flexible platform that supports multiple strategies, allowing traders to diversify and optimize their trades.

What tools can help with combining strategies on FXCI?

FXCI provides real-time analytics, stop-loss/take-profit orders, and risk management features that can help optimize your strategy combinations.

How do I know which strategy is best for me?

The best strategy depends on your trading style and the market conditions. It's important to experiment with different approaches and refine your strategy based on your results.