How do prop firms detect copy trading

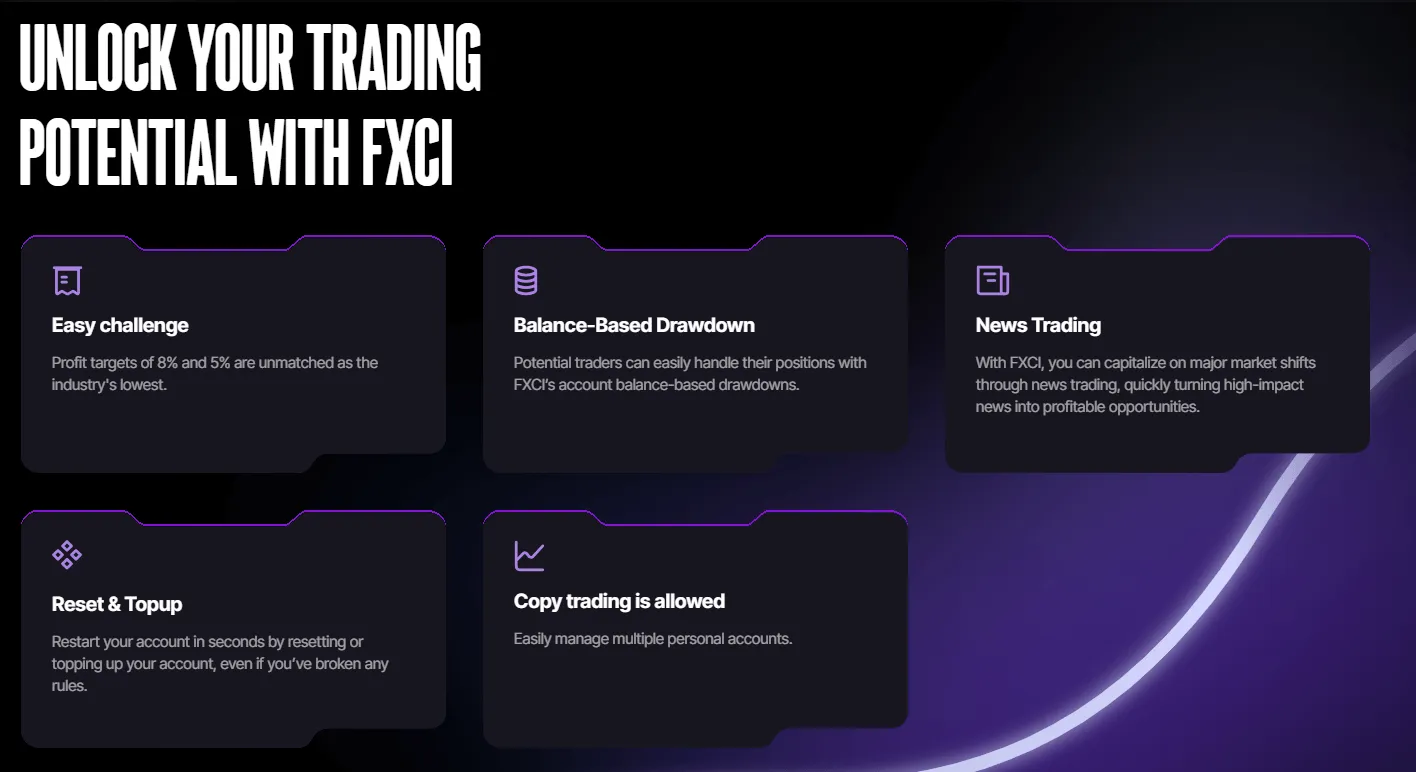

FXCI prop trading firm offers funded accounts up to $300,000 in India. Earn up to 99% profit trading with FXCI’s capital.

Save Big Today

Guaranteed 50% off with «FXCI50». Start instantly. Up to 99% profit share with FXCI. Claim your discount now ↓

In the world of proprietary trading, firms invest substantial resources into finding traders who have the skill and strategy to succeed. However, the emergence of copy trading, where one trader replicates another's trades, has raised concerns. The question is: How do prop firms detect copy trading? Understanding how these firms identify and manage copy trading can help traders ensure they operate within the firm’s rules and guidelines. This article explores the methods prop firms use to detect copy trading, and why it’s important for traders to know these methods.

How Do Prop Firms Detect Copy Trading? Key Methods

Copy trading presents a unique challenge for prop firms, as it can undermine their goal of assessing individual traders’ abilities. Here’s a breakdown of how prop firms detect this practice:

- Trade Pattern Analysis: Prop firms often have sophisticated software tools that analyze trade patterns. By monitoring trades, they can spot identical or nearly identical positions taken across multiple accounts. If trades match in timing, size, and asset choices, this is often a strong indicator of copy trading.

- Account Linkage Detection: Another method for detecting copy trading involves analyzing accounts for links or connections. Prop firms look for similarities in IP addresses, device fingerprints, or email addresses that indicate a group of traders may be copying from one another.

- Risk Profile Discrepancies: Prop firms often have systems that track the risk profiles of their traders. If a trader’s risk profile dramatically shifts, such as taking larger positions or making trades at unusual times, it could be a sign that the trader is copying someone else’s strategies.

- Advanced Algorithms: More advanced firms use algorithms designed to flag suspicious activity. These algorithms track historical data, comparing each trader’s performance with others within the firm. If someone’s performance mirrors another trader’s too closely, it raises a red flag.

Indicators of Copy Trading

It’s important for traders to recognize the signs of copy trading to ensure they are not violating their firm’s policies. Prop firms typically use the following indicators:

| Indicator | Explanation |

|---|---|

| Identical trade timestamps | Copy traders often execute trades at the same time or within a few seconds of each other. |

| Similar asset choices | Copy traders replicate the same assets or pairs consistently. |

| Duplicate position sizes | The size of the trades often matches across accounts. |

| Repetitive profit-loss ratios | Identical win/loss ratios or risk-to-reward values may indicate copying. |

These indicators are often used in conjunction with other methods to determine whether a trader is copying someone else’s positions.

How to Avoid Being Flagged for Copy Trading

Traders who want to avoid the pitfalls of being flagged for copy trading should follow these practices:

- Develop a Unique Strategy: Having a personal trading strategy not only helps avoid suspicion but also improves long-term profitability. Prop firms value individuality in their traders.

- Keep Trade Records: Maintaining a thorough record of your trades, including why and when you made them, can help demonstrate that your decisions are your own.

- Stay Informed: Being aware of your firm’s guidelines and the latest tools they use for detection can help you avoid unknowingly triggering their copy trading alarms.

- Use Independent Risk Management: Having a risk management plan that’s not reliant on others helps show that you’re making independent trading decisions.

Why Do Prop Firms Care About Detecting Copy Trading?

Prop firms are keen on ensuring that each trader operates independently, as this helps assess their true abilities and skills. When copy trading is detected, it can result in:

- Disqualification from challenges: If a trader is found to be copying trades, they may be disqualified from taking part in the firm’s challenges or even be banned from the platform.

- Loss of profits: Firms typically base profit-sharing on an individual’s performance, and if copying is detected, it could lead to unfair advantage claims, resulting in the loss of potential profits.

- Integrity issues: Prop firms are invested in maintaining the integrity of their platform. If copying is allowed to proliferate, it could undermine the fairness of the competition and the firm’s reputation.

Conclusion

Understanding how prop firms detect copy trading is crucial for any trader looking to enter or succeed in a prop trading firm. The methods outlined above—such as trade pattern analysis, account linkage detection, and the use of advanced algorithms—help maintain the integrity of the trading environment. For traders, developing a unique strategy and being aware of the detection methods is essential to ensuring fair play. By avoiding copy trading and demonstrating independent decision-making, traders can achieve long-term success and avoid falling foul of their firm’s policies.

FAQ

What is copy trading in prop firms?

Copy trading involves replicating another trader's positions, which can violate the individual performance expectations set by prop firms.

How do prop firms track copy trading activity?

Prop firms use a combination of trade pattern analysis, account monitoring, and algorithms to track copying behavior.

Can copy trading result in disqualification?

Yes, if a trader is caught copying another’s trades, they can be disqualified or banned from participating in firm challenges.

What are the best practices to avoid being flagged for copy trading?

Traders should develop a unique strategy, maintain trade records, stay informed, and use independent risk management to avoid detection.

What happens if I’m caught copy trading in a prop firm?

If caught, traders can lose access to the firm’s resources, forfeit any profits earned, and potentially face disqualification from future challenges.