FINAL HOURS! Save 50% on FXCI Challenges

Apply promo «FXCI50» for instant discount. Trade smarter with 99% profit retention. Start below 👇

Overview of FXCI in India

FXCI operates as a prop trading platform in India, offering various financial instruments and services to traders. The company provides access to forex, commodities, and indices through its prop trading software. Indian traders can open accounts with FXCI to participate in global financial markets.

FXCI aims to cater to both novice and experienced traders in India by providing educational resources, market analysis tools, and different account types. The platform allows Indian clients to trade with leverage, potentially amplifying both profits and losses.

Trading Instruments Available on FXCI

FXCI offers Indian traders access to multiple asset classes:

- Forex: Major, minor, and exotic currency pairs

- Commodities: Gold, silver, oil, and agricultural products

- Indices: Stock market indices from various countries

- Cryptocurrencies: Bitcoin, Ethereum, and other popular digital assets

The availability of specific instruments may vary depending on market conditions and regulations. Indian traders should review the current offerings on the FXCI platform for the most up-to-date information.

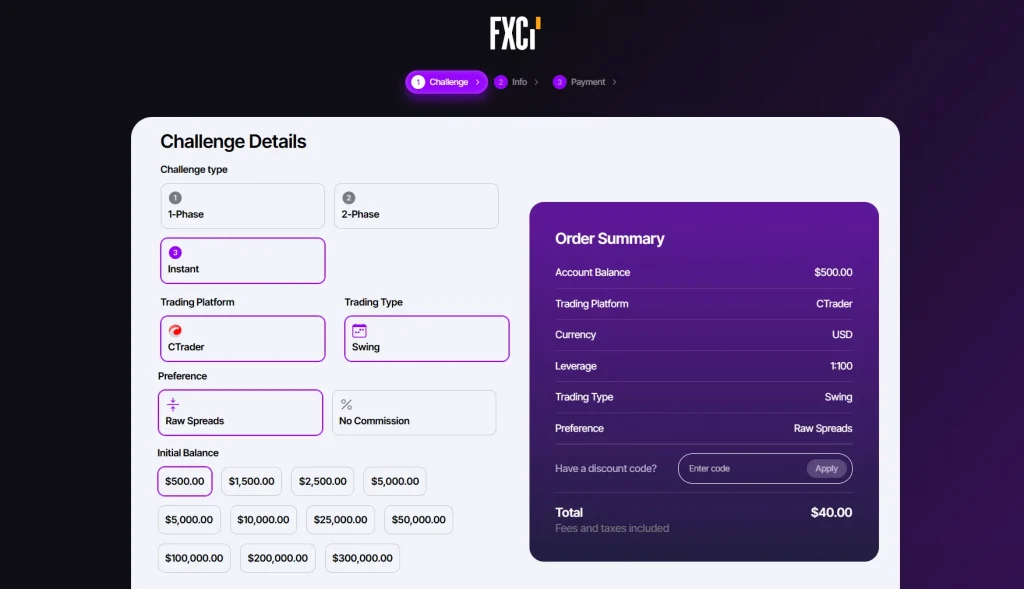

FXCI Review: Account Types for Indian Traders

FXCI provides different account types to accommodate various trading styles and experience levels in India:

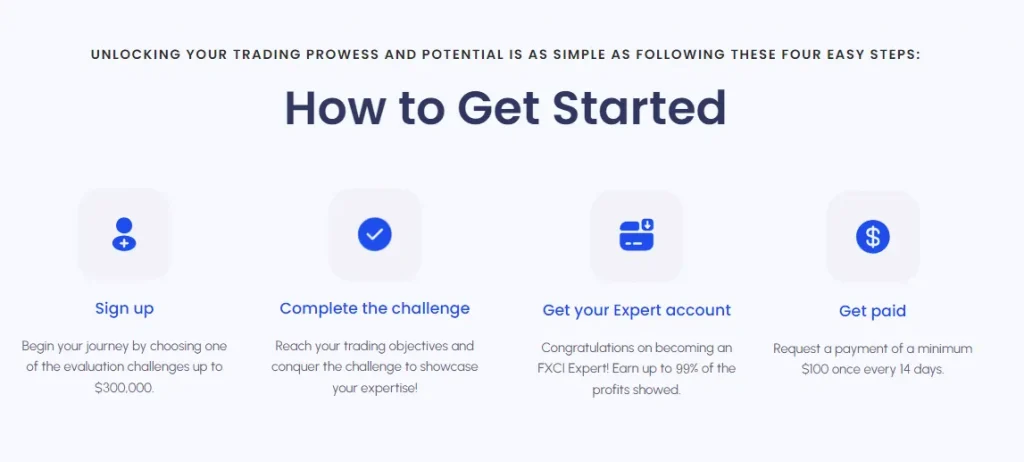

To become an FXCI Expert, you need to complete an evaluation that tests your strategy and discipline. After successfully passing, you’ll receive an Expert account.

We offer accounts ranging from $5,000 to $200,000. There are two types: Unlimited and Boosted.

Unlimited: consists of 2 phases.

- Choose your account size and platform (cTrader or YFT).

- In Phase 1, demonstrate consistent profitability across 100+ instruments.

- In Phase 2, prove your risk management skills.

- Receive your Expert account.

Boosted: consists of 1 phase.

- Choose your account size and platform (cTrader or YFT).

- Complete Phase 1 and immediately become an Expert trader.

Special offers: discounts and promotions are available via LiveChat or Discord.

Each account type offers specific features and conditions. Indian traders should carefully consider their trading goals and risk tolerance when selecting an account.

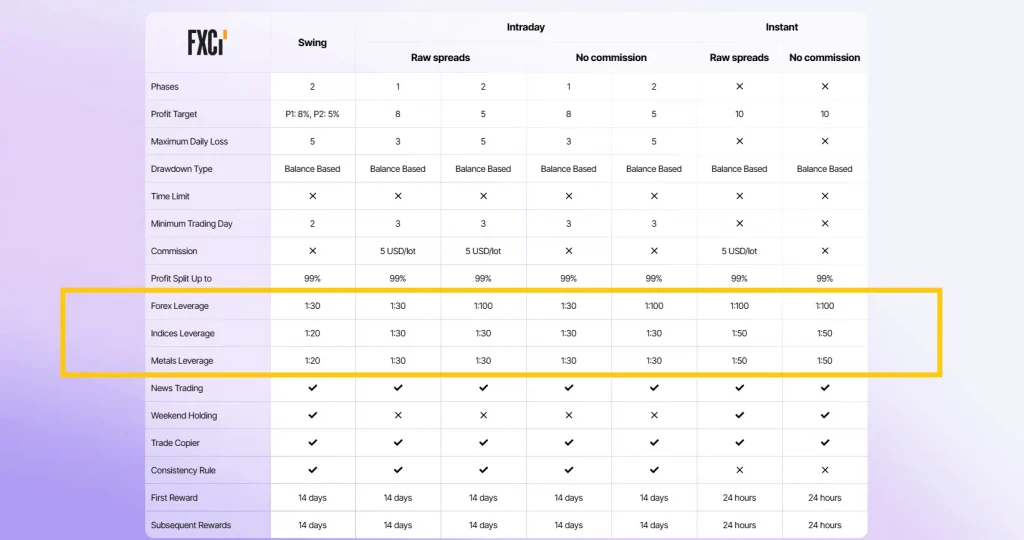

Leverage Options at FXCI

FXCI offers leverage to Indian traders, allowing them to control larger positions with a smaller capital outlay. The maximum leverage available depends on the account type and instrument being traded:

- Forex: Up to 1:100

- Indices: Up to 1:50

- Metals: Up to 1:50

The mandatory conditions for using leverage at FXCI are:

- A maximum daily drawdown of no more than 5% of the capital

- A maximum cumulative drawdown of no more than 10% of the deposit

- Closing losing positions upon reaching the margin call level

These risk management rules prevent the complete loss of capital even when using leverage.

FXCI Trading Platform Features

FXCI provides Indian traders with a proprietary trading platform that includes various features:

- Real-time price quotes

- Multiple chart types and timeframes

- Technical analysis tools and indicators

- One-click trading execution

- Mobile trading apps for iOS and Android devices

- Economic calendar and market news feed

- Risk management tools (stop loss, take profit)

- Account performance statistics

The platform is designed to be user-friendly while offering advanced functionality for more experienced traders.

Market Analysis Tools on FXCI

To assist Indian traders in making informed decisions, FXCI offers several market analysis tools:

- Technical Indicators: Moving averages, RSI, MACD, and more

- Charting Tools: Trendlines, Fibonacci retracements, and support/resistance levels

- Fundamental Analysis: Economic calendar and financial news updates

- Sentiment Indicators: Showing market positioning and trader sentiment

- Trading Signals: Suggestions for potential trade setups (available on select account types)

These tools aim to provide Indian traders with comprehensive market insights to support their trading strategies.

Deposit and Withdrawal Methods for Indian Traders

FXCI offers various options for Indian traders to fund their accounts and withdraw profits:

Deposit Methods:

- Bank wire transfer

- Credit/debit cards (Visa, Mastercard)

- E-wallets (PayPal, JCB, AstroPay)

- Cryptocurrencies (Bitcoin, Tether)

Withdrawal Methods:

- Bank wire transfer, ACH transfer

- E-wallets (Payoneer, Wise, Revolut and others)

Processing times and fees may vary depending on the chosen method. Indian traders should review the current terms and conditions for the most accurate information on deposits and withdrawals.

Customer Support for Indian Traders

FXCI offers customer support to assist Indian traders with account-related issues and platform inquiries:

- Live chat support

- Email support

- Phone support (during business hours)

- FAQ section on the website

Support is typically available in English, with response times varying depending on the nature of the inquiry and current support volume.

Risk Disclosure for Indian Traders

Trading financial instruments involves significant risk, including the possibility of losing more than the initial investment. FXCI advises Indian traders to carefully consider their financial situation and risk tolerance before engaging in trading activities.

Key risks to be aware of:

- Market volatility

- Leverage amplifying both profits and losses

- Counterparty risk

- Technical issues with the trading platform

- Regulatory changes affecting trading conditions

FXCI recommends that Indian traders thoroughly read the risk disclosure documents provided on the platform before opening an account.

User Feedback and Reviews

The following table summarizes common themes from user reviews of FXCI:

Aspect | Average Rating | Details |

Platform Usability | 4.5/5 | Generally user-friendly, some reports of occasional glitches |

Customer Support | 5/5 | Mixed feedback on response times and issue resolution |

Withdrawal Process | 4/5 | Some users report delays or difficulties with withdrawals |

Trading Conditions | 4/5 | Competitive spreads, concerns about slippage during volatile markets |

These ratings are based on aggregated user reviews and may not reflect every individual’s experience with FXCI.

Frequently Asked Questions (FAQs)

Withdrawal processing times can vary depending on the method used. E-wallet withdrawals are typically processed within 1-3 business days, while bank wire transfers may take 3-7 business days.

FXCI states that it provides negative balance protection on retail trading accounts. However, traders should review the current terms and conditions for specific details and any limitations.

One trader can manage up to $300k in funds in our prop firm. You can reach this amount by purchasing a single $300k account or several accounts of a different size, such as three $100k accounts or one $300k account and six $50k accounts.